Unique Info About How To Check Financial Statements

/financialstatements-aae574dcdec44b3c8113ec436a2e5c2a.png)

Pennsylvania requires that every llc operating in the state have a unique name.

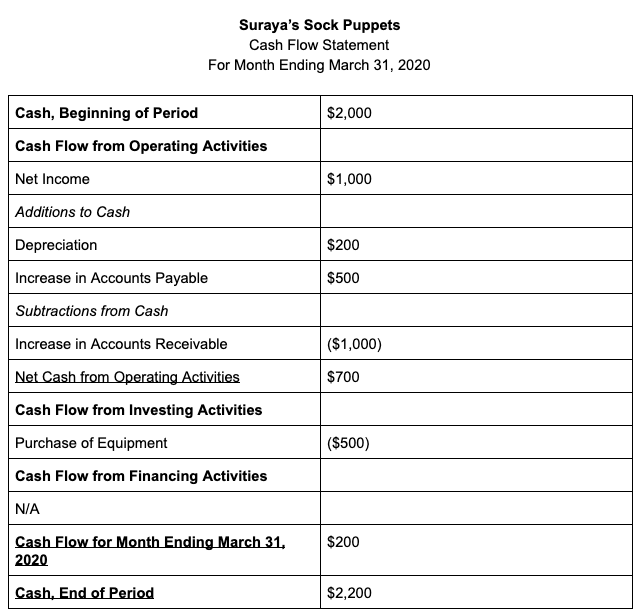

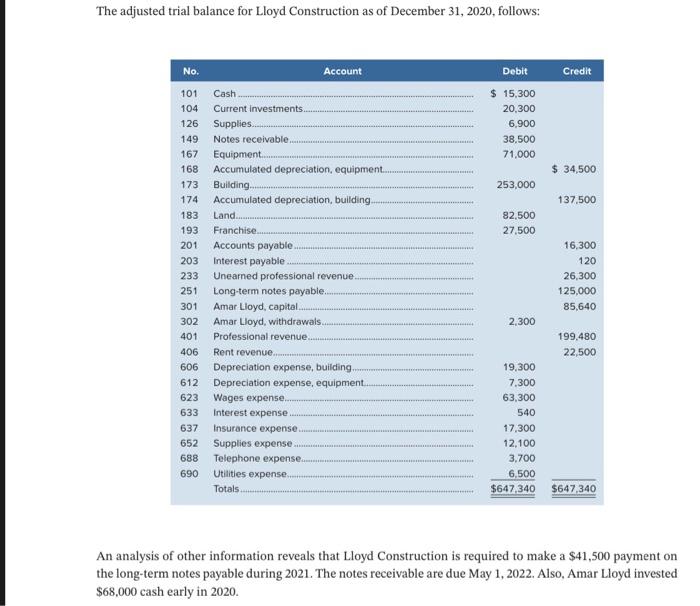

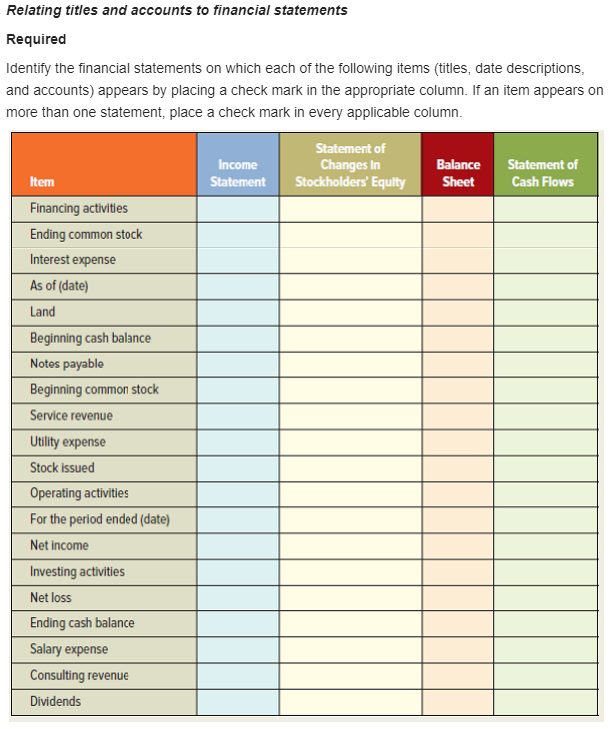

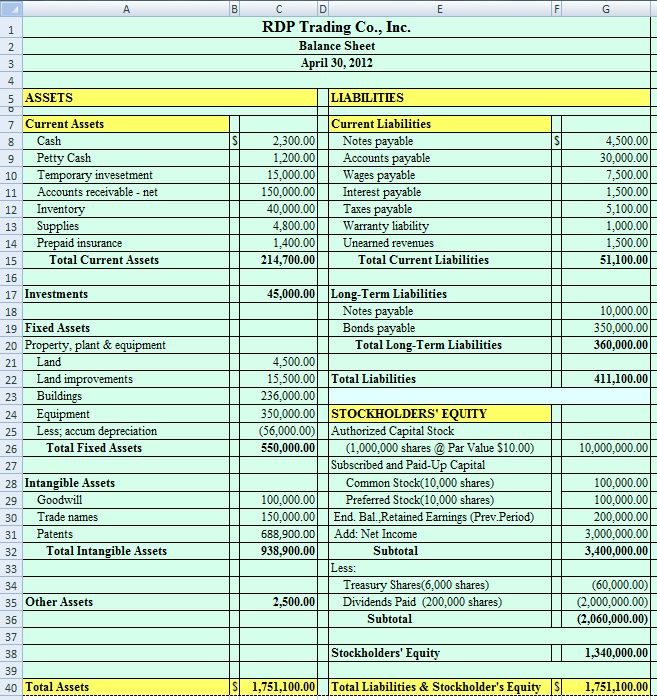

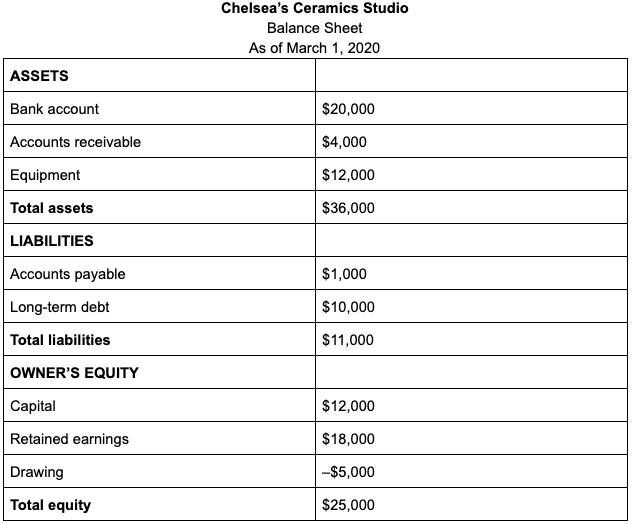

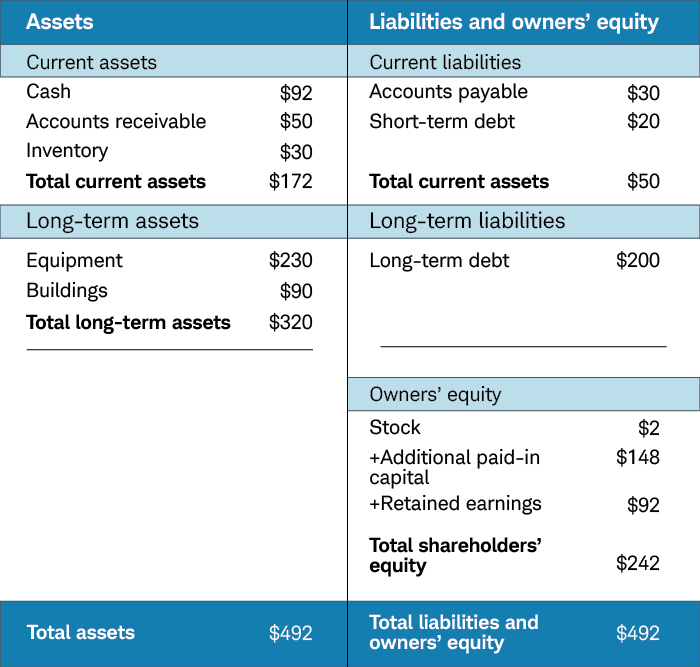

How to check financial statements. Expressed as a “snapshot” or financial picture of the company at a specified point in time (i.e., as of december 31, 2017) has three sections: Request audited financial statements signed by a certified public accountant. In the united states, private companies are not required to publish financial statements.

Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of w2 employees you had on the payroll in 2020. Just go to the site and enter the symbol or name of a company. Financial statements are formalized records of a business’s financial activities, position, and performance.

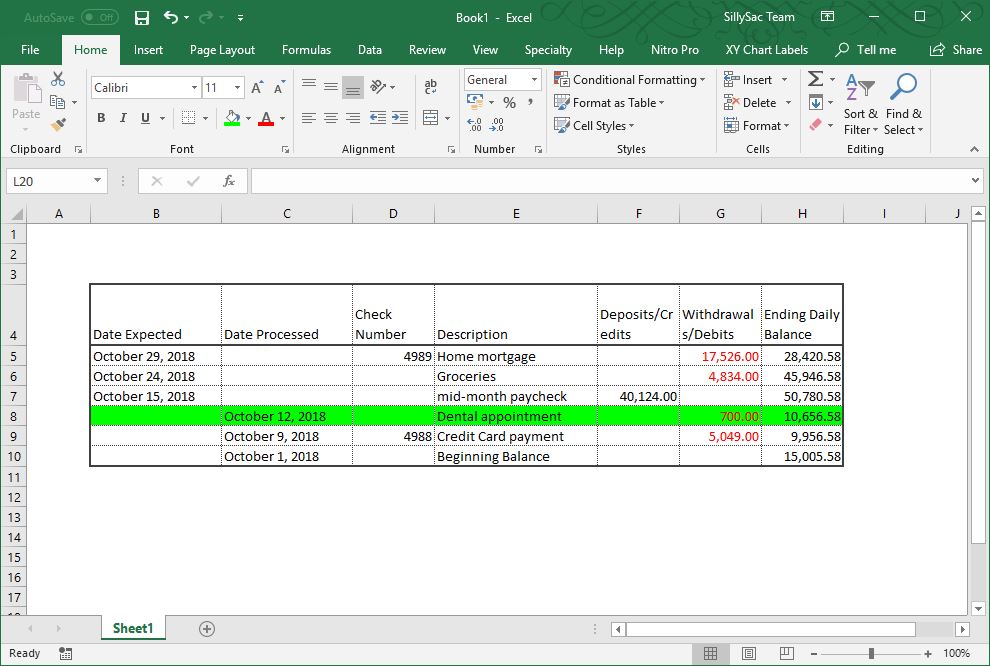

Check if the salaries are wages paid to. The cash flow statement shows how a company's liquid assets are increasing or decreasing over time. The same thing could be said today about a large portion of the investing public, especially.

A company's assets have to equal, or balance, the sum of its liabilities and shareholders' equity. They get mixed up about profits, assets, cash flow, and return on investment. 1. Hence, it can be challenging to get the financial statement of any of the private.

Well, you can find the financial statements of a company in any of the following sites: 1) bse/nse website, 2) investor relation page on company’s website 3) financial. Notes to the financial statement:

Positive cash flow indicates that more money is. If you can get more prior year information, even better. Verifying financial statements is possible in several ways.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.39.54AM-4a117e7e494c422ca6480746c97612a8.png)