Wonderful Tips About How To Lower The Interest Rate On A Credit Card

Here are four things that will likely get more expensive.

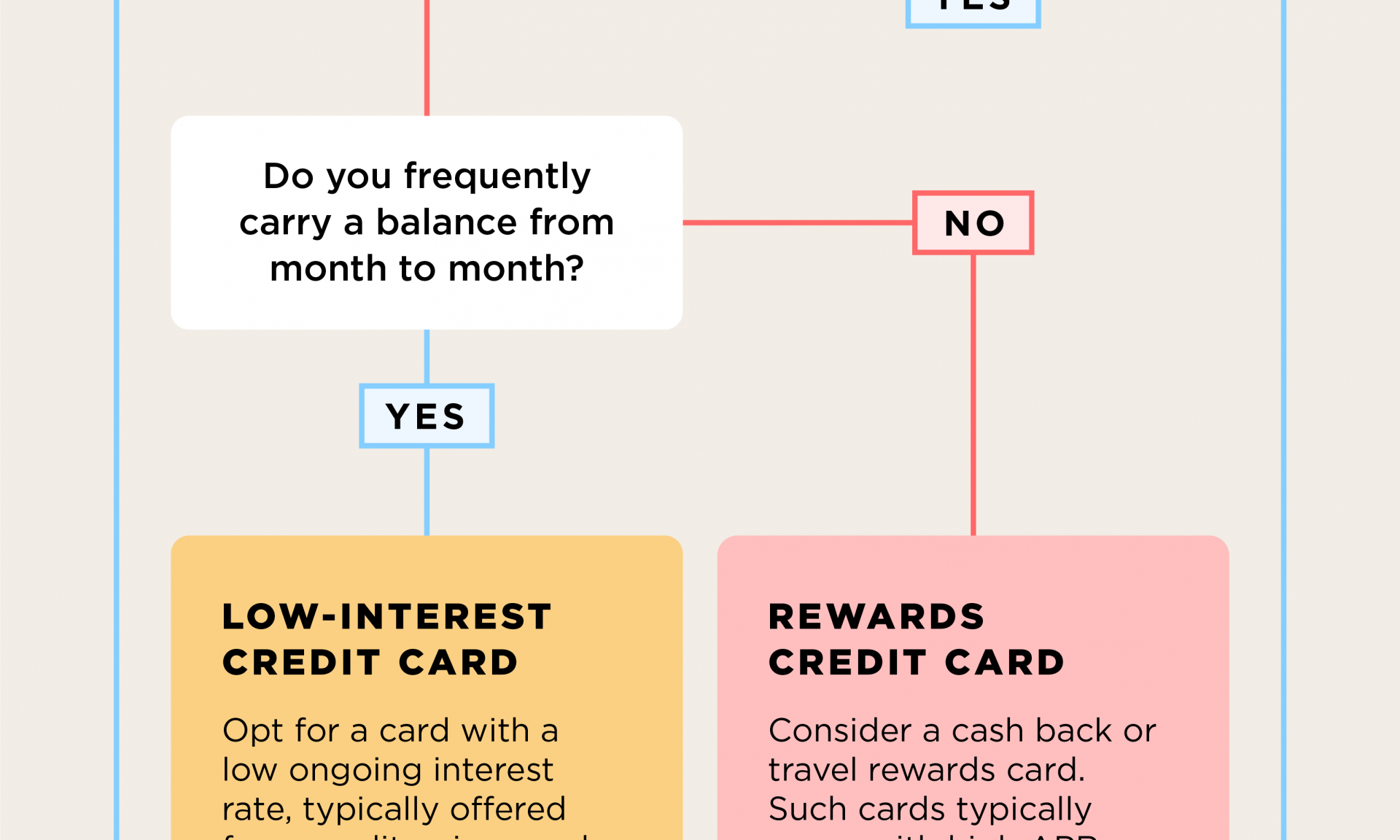

How to lower the interest rate on a credit card. One figure to keep an eye on is the “utilization rate,” which is the ratio of account balance versus the credit limit. If you’re looking for ways to reduce your credit card interest rate, here are two options which may help. Negotiate a lower credit card apr successfully securing a lower interest rate may take more than one phone call.

Credit card interest, and how it’s calculated,. How do fed rate hikes affect credit cards? If you’re already in debt and accruing interest on your balance, try to pay.

Here are a few tips for negotiating a lower interest rate: Make sure you know how much you owe to your credit card issuers before making a negotiation plan. Try again in a few months, because the company may be willing to offer an even lower interest rate.

Advertisement do your research before making the call before you make the call to your credit card issuer, make. The best way to avoid paying credit card interest is to pay your balance in full and on time each month. From there, add 20% or more to your total payment and apply it to the debt with the highest interest rate.

But data shows that 70% of those who ask for a. Once that’s paid off, roll that extra payment to the next card, and then the. Consider the following alternatives if you.

She received a letter from citi wednesday that her interest rate was being hiked. Requesting a rate reduction isn't the only way to score a lower rate on your credit card. Banks already do this with debt consolidation loans.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)