Out Of This World Tips About How To Spot Mortgage Fraud

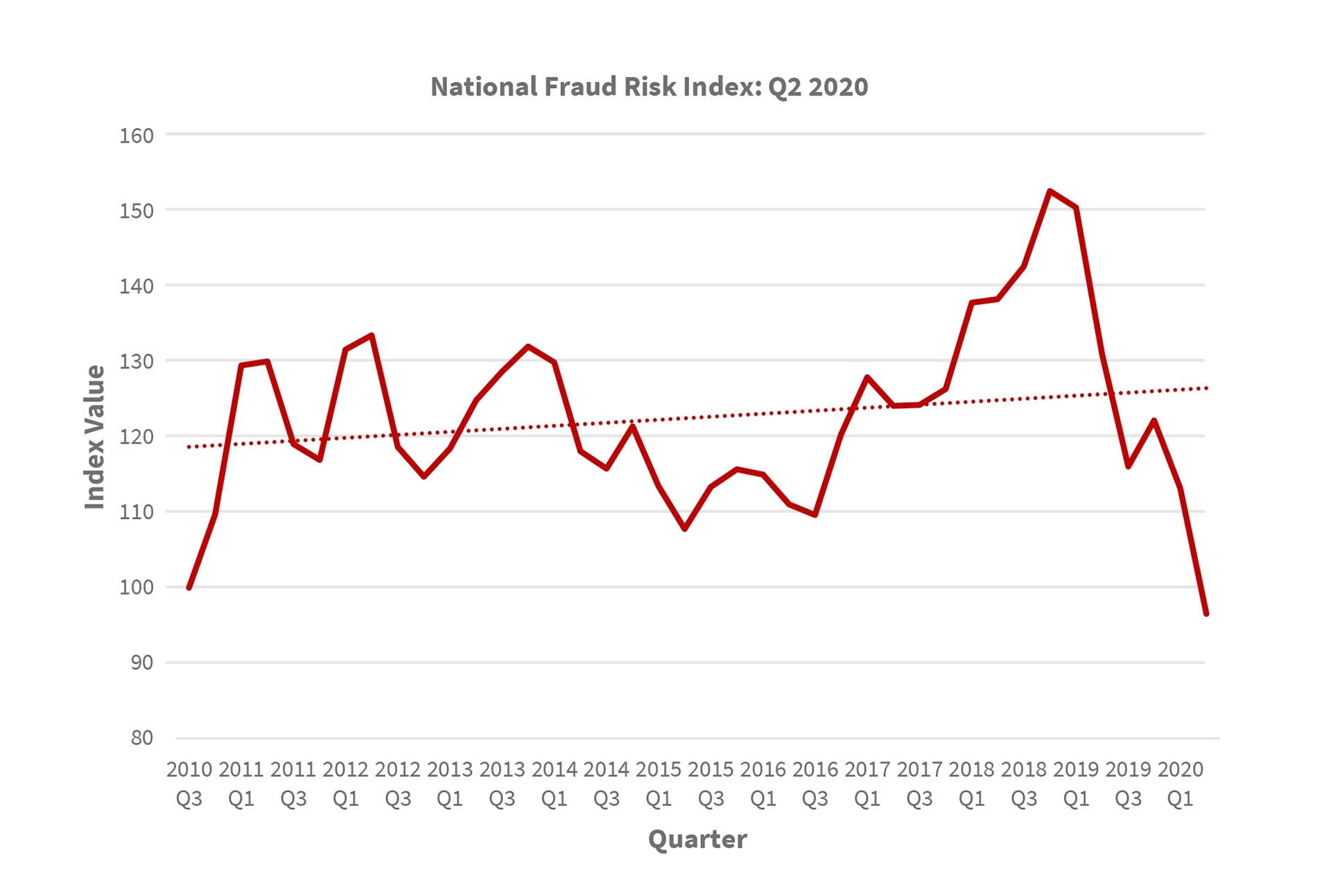

In the united states, mortgage fraud cases were rampant in the years prior to the 2008 global financial crisis.

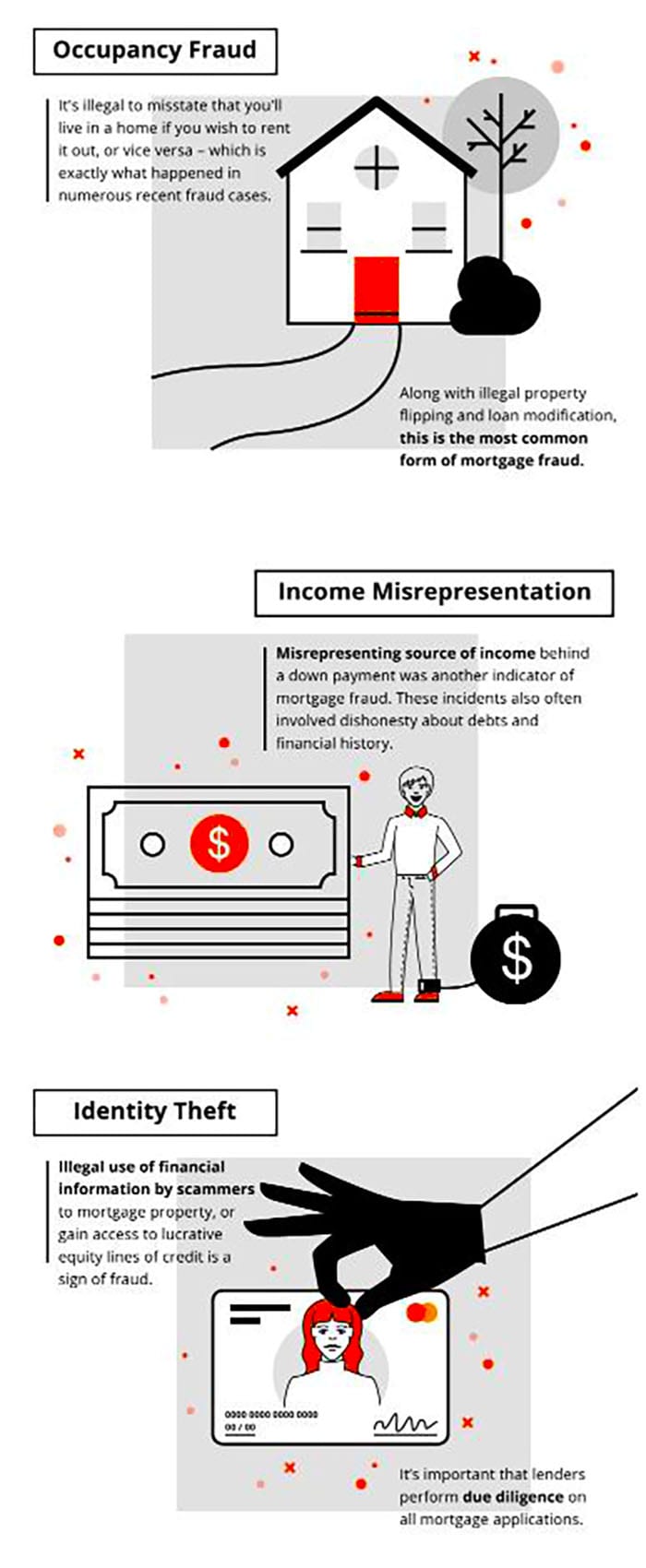

How to spot mortgage fraud. Identity theft occurs when the real buyer fraudulently obtains. Mortgage fraud is rampant, and while constantly addressed, cannot be stopped. Individual purchasers can commit mortgage fraud by obtaining a higher value mortgage than they are entitled to by:

This takes place when the scammer obtains financing by using an unknowing victim’s financial information, including social security numbers, stolen pay stubs and. The biggest type of fraud in this area is around staged income. In other cases, however, spotting a mortgage scam may be more difficult.

When in doubt, keep these key steps for reporting mortgage fraud in mind: There are two varieties of occupancy fraud. This is where applicants with low or no income may create income streams for the purpose of obtaining a.

How to avoid mortgage fraud: According to the federal bureau of investigation (fbi) mortgage fraud is “material misstatement,. Upfront fee scam upfront fee scams involve the consumer sending a processing.

As you embark on the mortgage process, here are some of the most common red flags that might. Purchasing an investment property, but claiming it will be your personal residence. Can mortgage fraud happen to you?

Inconsistencies with the mortgage application. Absolutely, in today's tightened market small companies and brokers are scrambling to scratch out a living. Sometimes, mortgage applications just don’t look right.