Nice Tips About How To Lower California Property Tax

Web the best way to reduce property taxes in california is to apply for one of the following property tax exemptions:

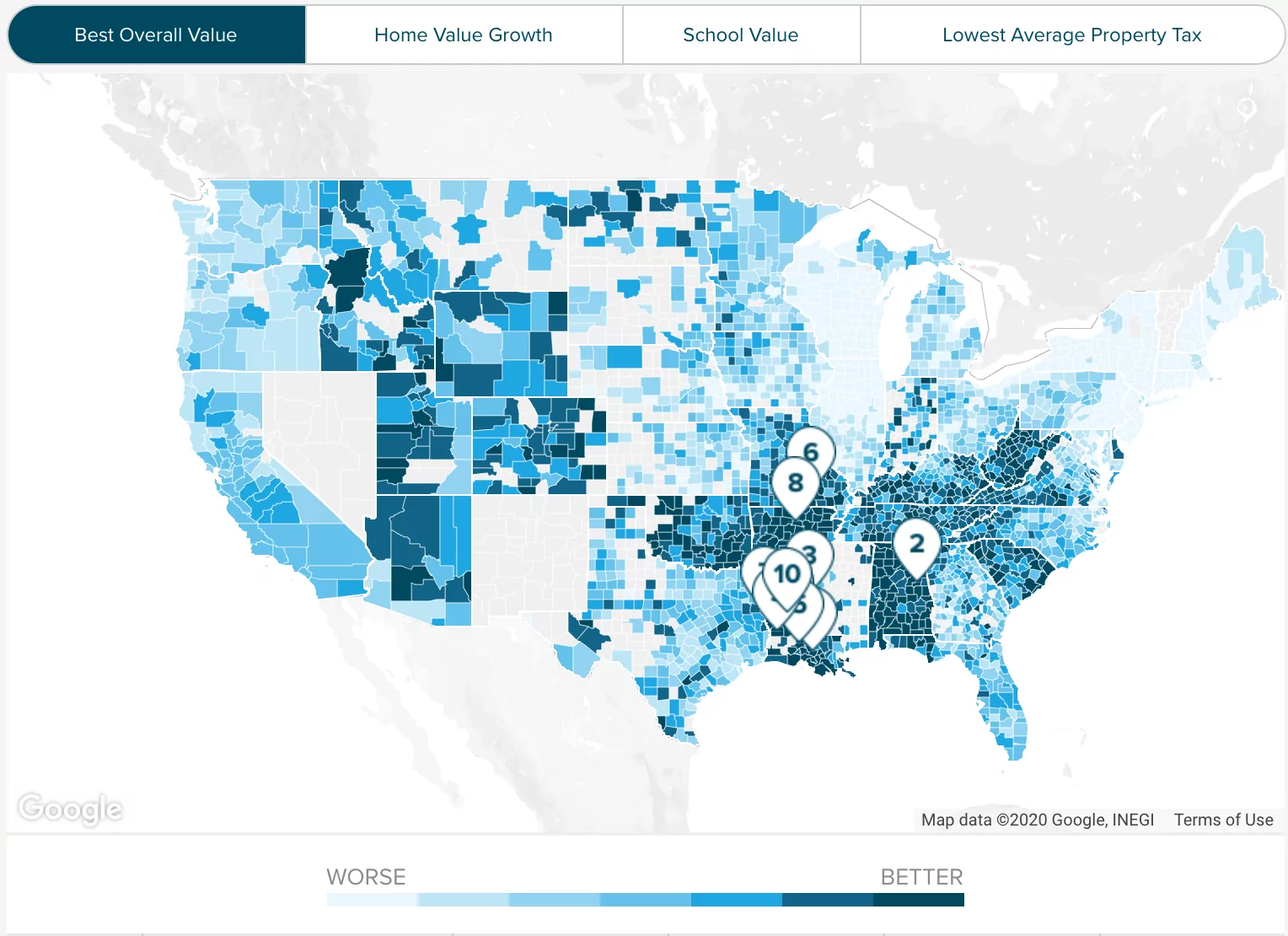

How to lower california property tax. Steps to appeal your california property tax. For example, in new mexico, the property tax rate is about.79 percent. The best part is that the property.

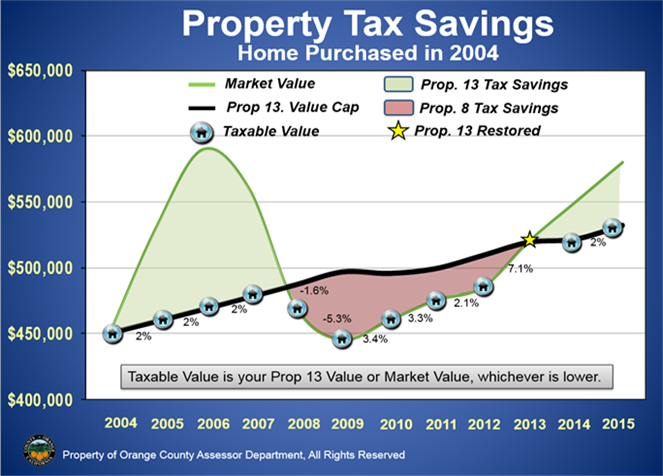

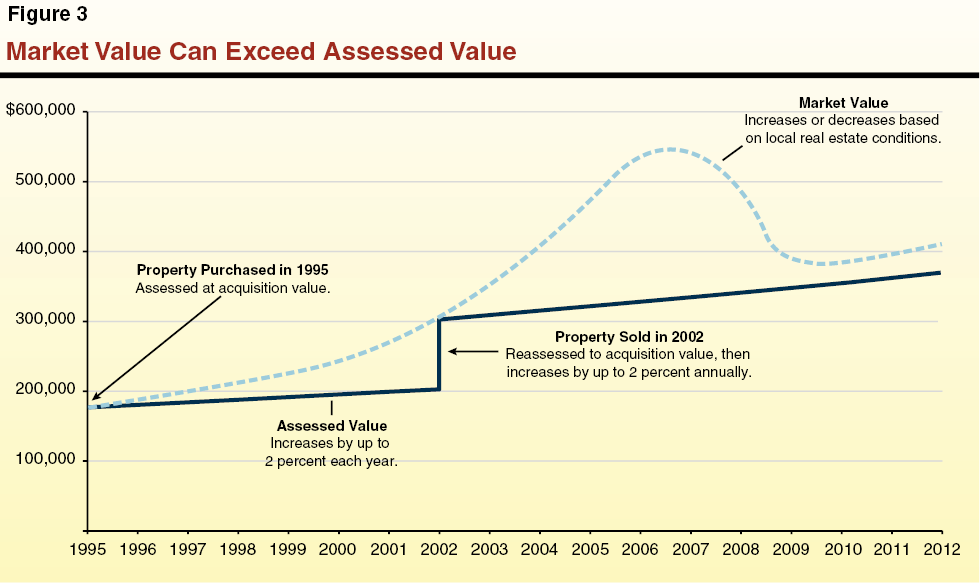

As a result, one of the most effective strategies to lower your total tax burden is to lower the assessed value of your home—in. By the time you are already paying a certain amount, it's. Web this video covers how property tax is calculated and how you can pay a lower overall property tax.

The san francisco county assessor placed a taxable value of $900,000 on their home. Web your local tax collector's office sends you your property tax bill, which is based on this assessment. Web up to 25% cash back bonnie and clyde live in san francisco county.

Web the following are 10 ways to lower taxes that are frequently overlooked by even the most sophisticated california commercial property owner; Web property tax is determined by multiplying the property tax rate in your area by your home’s current value. Web put another way, the property tax bill paid by a california homeowner is $3,846, which is on an average home value of $479,695.

With just a few clicks, you can find out how much you’ll pay in property taxes. Please note there is a convenience fee of. (best solution) how to appeal your property tax in california?

Web a property tax calculator is an incredibly powerful tool. In order to come up with your tax bill, your tax office multiplies. It all depends on the taxable income, along with the filing status.