Underrated Ideas Of Tips About How To Become Non Resident Uk

You rent out property in the uk;

How to become non resident uk. A uk residence card or brc is different from a ‘biometric residence permit’ (brp). If you’ve been uk resident in at least one of the three previous tax. You have other untaxed income

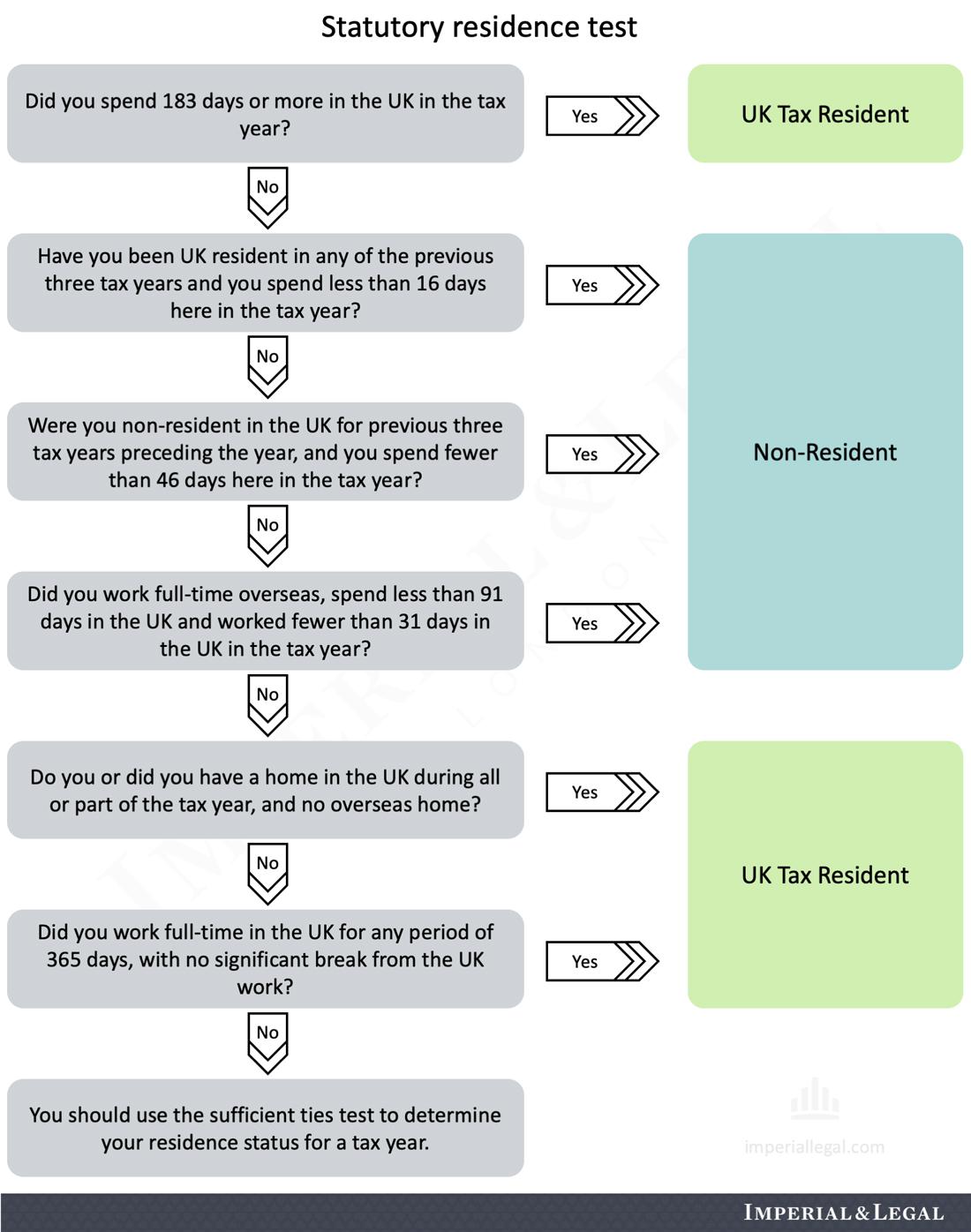

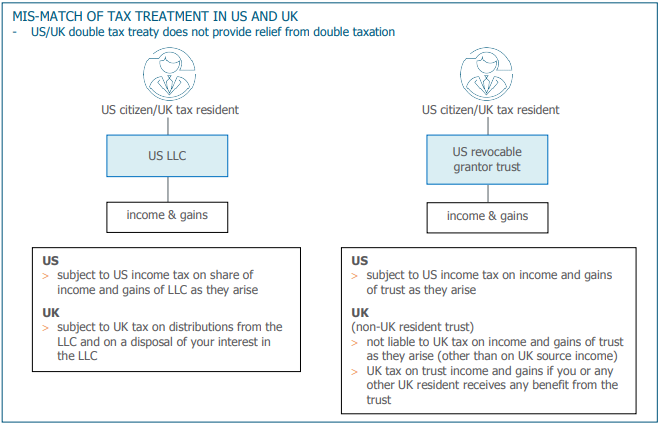

Expats can become non resident in the uk by living for 183 days or more in another country as a tax resident there. The threshold for meeting this test is very high and also depends on whether you’ve been uk resident previously. You do not pay uk tax on your foreign income or gains if both the following apply:

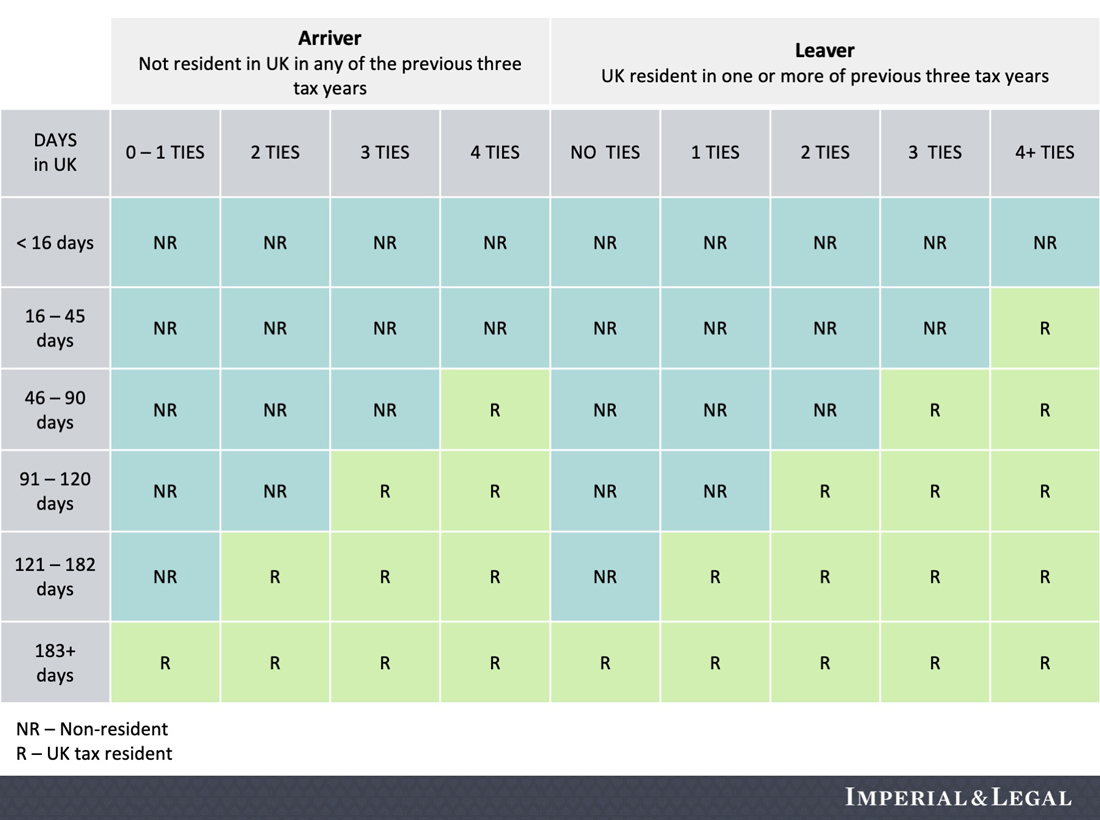

The conditions are that the individual: You spent fewer than 16 days in the uk (or 46 days if you. There are three possible tests, and if an individual satisfies any one of these they will be not be uk resident in the relevant tax year.

You meet one of the automatic uk tests or the sufficient ties test; While you may be considered a tax resident, your domicile will. There are three possible tests in the aot and if an individual satisfies any one of these they will be not resident in the uk in the relevant tax year.

You work for yourself in the uk; If you are non uk resident, are not a uk director or employee and have no uk income or tax liability write to. If you are currently uk resident and want to escape the uk tax net or avoid becoming deemed domiciled (or just escape the uk!), you need to become non.

Get personalized advice about tax, asset protection, offshore banking, residency, and citizenships: You have a pension outside the uk and you were uk resident in one of the 5 previous tax years; This is known as the 183 day tax rule.