Beautiful Tips About How To Appeal Property Taxes In Michigan

Follow this link for information regarding the collection of.

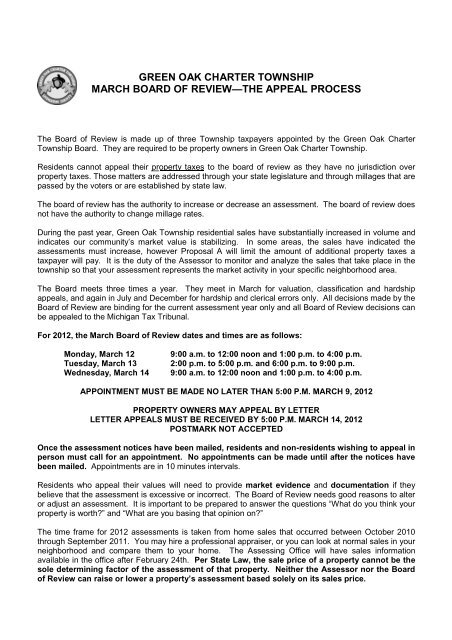

How to appeal property taxes in michigan. Homeowners in michigan are assessed every year by a local tax assessor. Classification of real property faq. For properties classified as commercial or industrial, appeals can be filed directly to the michigan tax tribunal, without appearing before the local board of review.

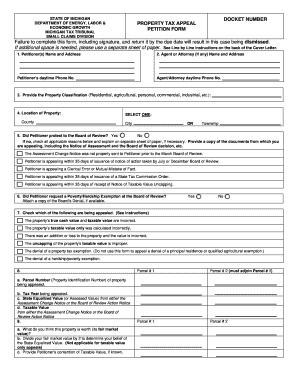

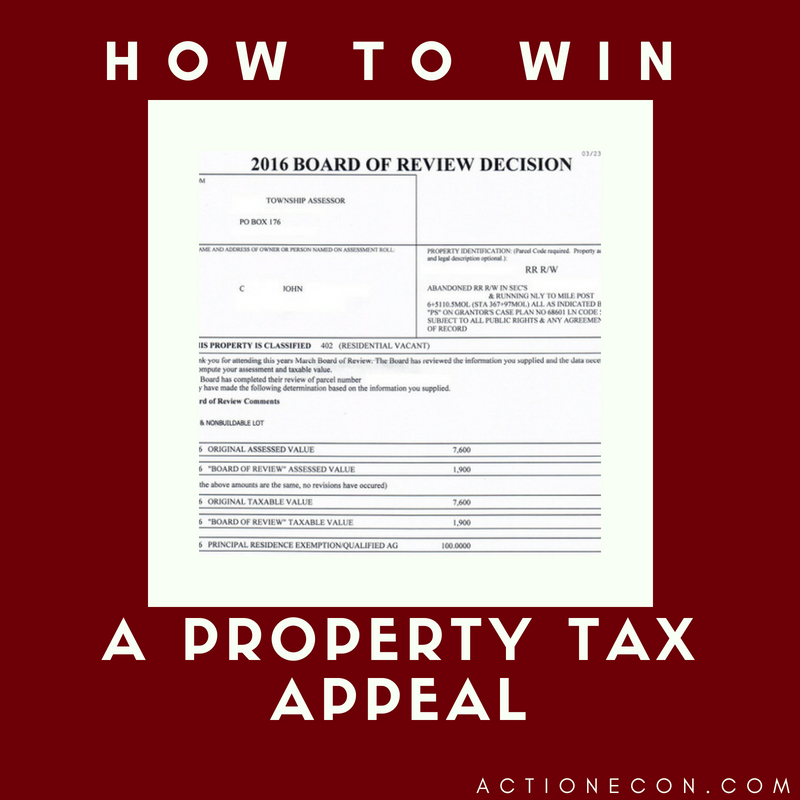

Valuation appeal (or property tax appeal) the property is residential. Your board of review decision should include basic instructions. Assessor's petition for change of property classification.

An appearance at the local board of. The state education tax act (set) requires that property be assessed at 6 mills as part of summer property tax. You will recieve a notice of when they.

With many citizens still reeling from the economic downturn caused by the global pandemic, increased property taxes can be a huge issue for. Depending on your specific situation, other forms of evidence may assist you in appealing your michigan property tax assessment. Your account number is your social security or tax identification.

How to appeal property taxes in michigan. Start your appeal, get assigned a docket number, you then will need to file a motion to conduct discovery. Valuation appeal (or property tax appeal) michigan tax tribunal.

Write your assessment number and account number on the check. Those deadlines have not been extended as a. A michigan property tax lawyer can help.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19631901/Screen_Shot_2020_01_27_at_10.12.12_AM.png)